The QZ Asset Management website has recently been taken offline, signaling the downfall of the notorious “SEC audit” exit scam perpetrated by this Ponzi scheme. Additionally, the social media accounts associated with QZ Asset Management have been removed from public view.

QZ Asset Management emerged onto the scene in late 2022, enticing investors with promises of a remarkable 400% return on investment through its MLM crypto Ponzi scheme. The primary target market for QZ Asset Management and its promoters appeared to be investors in Africa, while the alleged masterminds behind the operation were believed to be Chinese scammers operating out of Hong Kong

The scheme’s exit hoax gained momentum with the fraudulent announcement of a NASDAQ listing in late March, misleading investors further. Subsequently, on May 1st, QZ Asset Management abruptly halted withdrawals, intensifying concerns about the legitimacy of the operation.

CEO Blake Yeung Pu Lei attempted to placate investors by attributing the disruption to an upcoming SEC audit, a claim that held no merit since the SEC does not conduct audits of private corporations outside of regulatory enforcement proceedings.

Amidst the dissemination of misinformation regarding the false NASDAQ listing by prominent promoters, QZ Asset Management has been strategically distancing itself from its victims in Africa over the past few weeks.

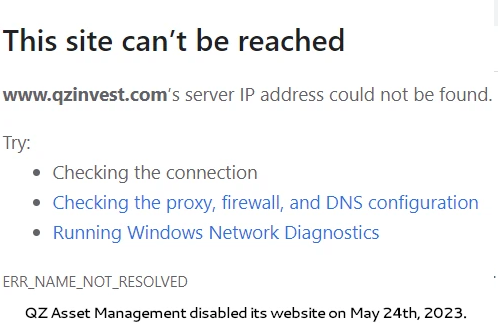

Now, all of these deceptive tactics have come to a screeching halt. QZ Asset Management has taken down its website and removed its previously accessible YouTube and Facebook accounts. While the Twitter profile for QZ Asset Management remains active, the account vanished back in February.

Considering the distribution of cryptocurrency to offshore criminals and the unlikelihood of regulatory action from China, it seems improbable that QZ Asset Management will face consequences in that jurisdiction. Furthermore, African authorities may find themselves powerless to take any significant action in this matter.

The precise number of victims affected by QZ Asset Management and the extent of their financial losses remain uncertain at present, pending unlikely updates in the future.

Leave a Reply